The Case for Staying Invested

Timing the market might feel proactive—but history shows that consistent, long-term investing has typically produced better outcomes.

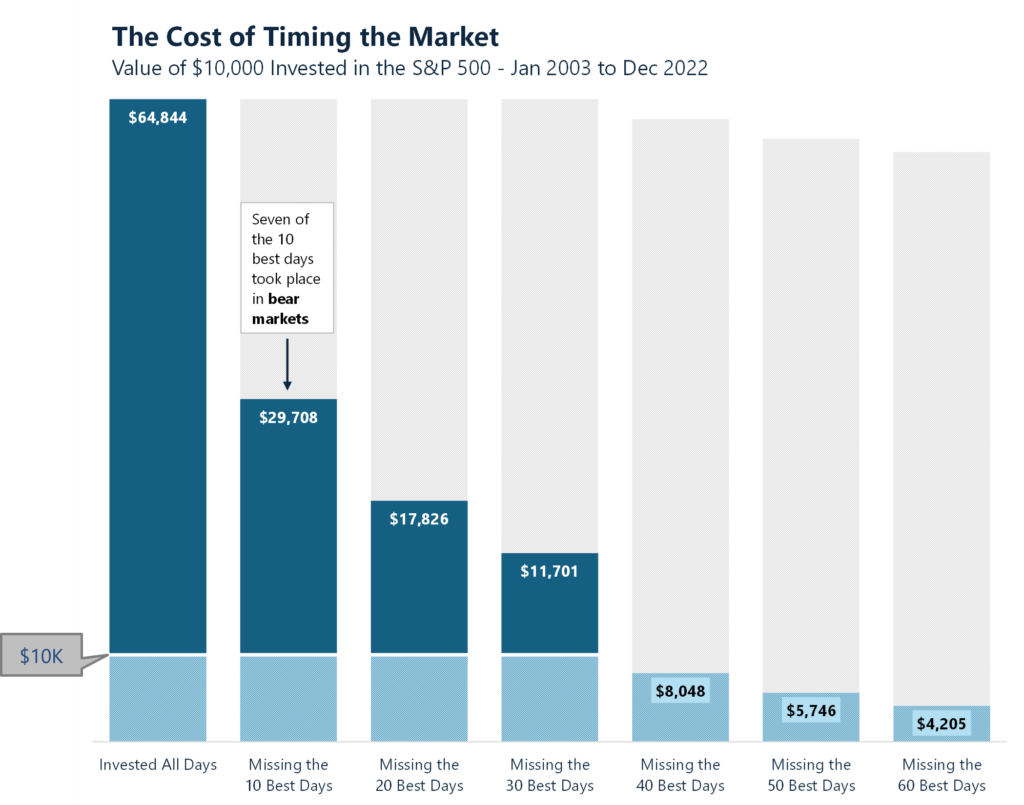

If you had invested $10,000 in the S&P 500 and left it untouched for 20 years, your investment would have grown to $64,844. But if you missed just the 10 best market days during that period, your return would have been cut in half. Missing the 60 best days would have reduced your investment to just $4,205.

This dramatic difference highlights one of the most important investing lessons: it’s not about timing the market—it’s about time in the market.

Past performance is no guarantee of future results. Source: RiskBridge, JP Morgan, data from January 2003 to December 2022

Why Market Timing Doesn’t Work

Market highs and lows often happen in close succession. Some of the strongest market days occur during periods of uncertainty or volatility—right when investors are most likely to pull out.

Trying to perfectly time the market requires being right twice:

- Knowing when to exit

- And knowing exactly when to get back in

Even professional investors struggle with this consistently. Most people miss out on gains by waiting for the “perfect” moment to reinvest—which often never comes.

The Emotional Side of Investing

Let’s face it—market drops can be unnerving. It’s human nature to want to avoid losses. But reacting emotionally to short-term market movements can sabotage your long-term strategy. Building wealth over time requires discipline, patience, and perspective. Staying invested—even when the market is turbulent—often puts investors in a better position to benefit from eventual recoveries.

A Long-Term Perspective with a Strategic Mindset

Investing isn’t about reacting to headlines. It’s about keeping your eyes on your long- term goals.

A thoughtful, long-term strategy can help you navigate around risks while also uncovering opportunities that emerge in every market cycle. When you allow your portfolio to grow through market ups and downs—guided by a plan tailored to your needs—you’re making progress toward goals that go beyond any single moment in time.

At Finley Davis Private Wealth, we believe your strategy should reflect your personal vision—not the market’s daily swings.

Opportunities Exist in Every Market Cycle

We help clients navigate risk and uncover opportunities that align with their goals. If you’re looking for a team that can help guide you through every season of the market, let’s start the conversation.

DISCLOSURES:

Past performance is no guarantee of future results. Personnel of RiskBridge

Advisors, LLC (“RiskBridge”) prepared this material. The views expressed herein do not

constitute research, investment advice, or trade recommendations. RiskBridge may,

from time to time, participate or invest in transactions with issuers of securities that

participate in the markets referred to herein, perform services for or solicit business

from such issuers, and/or have a position or effect transactions in the securities or

derivatives thereof.

All references to index funds and other economic indicators are provided for illustrative

purposes only. Investors cannot invest in an index, and indexes do not reflect the

deduction of advisor’s fees or other trading expenses.

Information about benchmark indices is provided to allow you to compare it to the

performance of RiskBridge portfolios. Investors often use these well-known and widely

recognized indices as one way to gauge the investment performance of an investment

manager’s strategy compared to investment sectors that correspond to the strategy.

However, RiskBridge’s investment strategies are actively managed and not intended to

replicate the performance of the indices: the performance and volatility of RiskBridge’s

investment strategies may differ materially from the performance and volatility of their

benchmark indices, and their holdings will differ significantly from the securities that

comprise the indices. You cannot invest directly in indices which do not take into

account trading commissions and costs. Net total return indices reinvest dividends after

the deduction of withholding taxes, using (for international indices) a tax rate applicable

to non-resident institutional investors who do not benefit from double taxation treaties.

S&P 500® Index is a market capitalization-weighted index of 500 of the largest U.S.

companies, designed to measure broad U.S. equity performance.

This material is distributed for informational purposes only. All material presented is

compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and

RiskBridge makes no representation as to its accuracy or completeness. Any opinions,

recommendations, and assumptions included in this material are based upon current

market conditions, reflect the judgment of RiskBridge as of the date indicated, and are

subject to change without notice. You acknowledge and agree that RiskBridge is not

obligated to provide any additional information or update such information in making

the information available. Securities and/or indices highlighted or discussed in this

communication are mentioned for illustrative purposes only and should not be

construed as investment recommendations. All investments involve risk, including the

loss of principal. Before implementing any strategy, consult with a qualified financial

adviser and/or tax professional. This information is not intended to provide investment,

tax, or legal advice, and this material is not to be relied upon in substitution for the

exercise of independent judgment. This material is not to be reproduced, in whole or

part, without the written consent of RiskBridge.